- Home

- About

- Documentary Printed Precancels

- The Fullerton List

- NYSE Brokers 1898-1902 A thru K

- NYSE Brokers 1898 - 1902 L thru Z

- Insurance Agents

- Insurance Companies

- CBOT

- Railroads

- On-document Uses with Frank Sente

- Revenue Stamped Paper with Bob Hohertz

- On Beyond Holcombe with Malcolm Goldstein

- Graded Stamps

Friday, September 30, 2011

Thursday, September 29, 2011

New York Stock Brokers and Cancel for September 30: De Coppett & Company

Wednesday, September 28, 2011

New York Stock Brokers: Van Schaick & Company

New York Tribune classified advertisement

January 1, 1903

VAN SCHAICK & CO.

DEC

17

1900

Dave Thompson scans

Jenkins Van Schaick, member, New York Stock Exchange.

Photo available from King's Views of the New York Stock Exchange.

Mr. Van Schaick died in April 1899. His firm survived him.

Mr. Van Schaick was a rather colorful character. See the article below:

From The New York Times, July 26, 1894:

PUNISHED FOR BAD LANGUAGE

Jenkins Van Schaick Suspended from the Stock Exchange for Thirty Days.

Jenkins Van Schaick, whose membership in the Stock Exchange dates back to 1857, and who has been prominent in club life and local politics for many years, has suffered the displeasure of the authorities at the Exchange. They suspended him yesterday for thirty days. The offense for which they meted out this punishment occurred last Friday. On that day, Mr. Van Schaick, as had frequently happened before, displayed great activity in the sugar crowd. He bought heavily, and seemed to never get enough. His plans moved well until Joseph A. Blair began to bid against him. Then Mr. Van Schaick, into whose hands the stock had been falling easily at moderate advances, had to climb to get anything.

He did not enjoy the new sensation. The fact that Mr. Blair was the cause of it acted as an irritant upon him. They had been in conflict before, and their differences had to be settled in court. Mr. Van Schaick became furious, as he thought that Mr. Blair had taken this way to balance part of the court's verdict, which had been adverse to him. When he could no longer restrain himself he turned upon Mr. Blair and exclaimed:

"You are a nice sort to bid against me. Why, you are no better than a thief. I stopped you once, when you tried to cheat me out of $7,000. Now what are you up to? Do you want to make me pay for beating you?"

"Whatever I am, I don't try to escape payment of my just taxes," Mr. Blair hotly replied.

Thee was a great confusion in the crowd at the moment, and although what more was said could not be heard, the two men seemed ready to jump at each other when they were dragged off in different directions. Mr. Blair went to the Complaint Committee, whose inquiry resulted in Mr. Van Schaick's suspension for "conduct detrimental to the interests of the exchange."

This affair does not end the bad feelings between the two men. Mr. Blair said yesterday that he did not hear Mr. Van Schaick say anything about "thief" on the floor. Mr. Van Schaick had taken care to use that epithet only when out of Mr. Blair's reach. When this was reported to Mr. Van Schaick he said: "I did say on the floor that he was no better than a thief, and I will repeat to his face whenever it may suit him to hear it. Suspension is not a pleasant thing for a veteran like myself, but this affair was too much for my good nature. It has had one compensation, for on Monday Blair sent me a check for $530 to settle an old debt I never expected to collect."

Railroad Presidents: Roswell Miller, Chicago, Milwaukee & St. Paul Railway

Photo of Roswell Miller from King's Views of the New York Stock Exchange, 1897. He would retire from the Presidency of the Railroad in 1899.

Chicago, Milwaukee & St. Paul 1901-cancelled 2 cent documentary battleship from the post-Roswell Miller era.

From the New York Times, September 24, 1899:

NEWS OF THE RAILROADS

Roswell Miller Retires from the Presidency of the St. Paul and Albert J. Earling Succeeds Him.

MILWAUKEE, Wis., Sept. 23.--At the annual meeting of the Chicago, Milwaukee and St. Paul Railway Company, held here today, former Second Vice President Albert J. Earling of Chicago was elected President of the road, vice Roswell Miller, who was elected Chairman of the Board of Directors. Mr. Miller's Retirement from the Presidency was entirely unexpected outside the inner circles of the company.

While Mr. Miller is still is still the executive head of the road, the change in the organization will relieve him of a large part of his operative duties and confine his duties to the financial affairs of the company. Mr. Earling will have absolute charge of all matters of operation...

Sunday, September 25, 2011

New York Bankers, Banks & Trusts: The National Park Bank

THE N. P. B.

MAY

15

1900

N. Y.

Dave Thompson scan

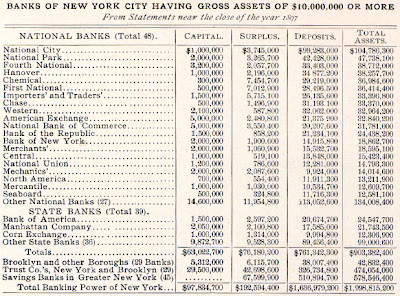

The National Park Bank was one of New York's and the nation's largest banks in 1900 at the time of this cancel.

Banks in New York City as of 1897 showing the National Park Bank as the #2 bank in total assets, ahead of banks like Chemical, Chase, Hanover, and the Bank of New York.

EDWARD E. POOR AND RICHARD DELAFIELD.

As the active heads of the bank does the largest commercial business in the country, President Edward E. Poor and Vice President Richard Delafield of the National Park Bank are two of the interesting men of the New York financial world, and a word as to their personalities follows appropriately the sketches recently give in these columns as to the personnel of some of our city banks...

The home of the bank has been [the same] building since 1867. Its charter dates from 1856. In spite of the great growth of the business, its original capital of $2,000,000 has never been enlarged, the measure of its prosperity being represented by a surplus of $3,700,000. While the city business of the bank is enormous, its out-of-town connections are world-wide. The deposit of the bank is $50,000,000. It is the agent and depository of a long list of banks in Canada, Great Britain, and other countries and to the banks in the Southern States it has long been a sort of "father confessor," extending help to them when needed, and thus playing a prominent part in the movement of the great cotton crop.

It is this wide-reaching sphere of influence that has built the business of the National Park Bank up to where it exceeds that of any other in the country and made it one of the notable institutions of the metropolis. Locally this sphere is soon to be enlarged. The Directors of the National Park Bank have acquired an influential interest in the Plaza Bank, at Fifth Avenue and 58th Street, and the Plaza will be operated hereafter in harmony with the downtown institution.

In addition to President Poor and Vice President Delafield, the roster of officers of the National Park Bank includes the names of Stuyvesant Fish [1], as a Vice President...among the Directors are Joseph T. Moore, George S. Hart, Charles Sternbach, Charles Scribner, Edward C. Hoyt, W. Rockhill Potts, August Belmont [2], Francis R. Appleton, John Jacob Astor [3], George Frederick Vietor, and Herman Oelerichs--a list which, to those who know New York, both proclaims and explains the wide fame and high repute of this institution.

1. Stuyvesant Fish: Fish was the President of the IC RR and a Vice President of The NPB.

2. August Belmont, Director The NPB and member of the New York Stock Exchange

3. John Jacob Astor IV: Astor, an inheritor of a vast fortune, was one of the most famous and certainly the richest man to die in the sinking of the Titanic in 1912.

Saturday, September 24, 2011

Railroad Presidents: Collis P. Huntington, Southern Pacific

SO. PAC. CO.

JUL

11

1898

Collis Huntington was far more than the President of the Southern Pacific during his lifetime. He was the driving force behind the organization and execution of the Central Pacific Railroad, the railroad that began in California and laid track to Utah to join up with the Union Pacific to create North America's and the United State's first transcontinental railroad.

He also became a key figure in one of the great eastern railroads, the Chesapeake & Ohio Railway. His power and influence for the railroad led to the naming of Huntington, West Virginia, after him. The Southern Pacific was perhaps his greatest corporate success, as the SP built its own line south through California and across the United States to New Orleans. The SP became a long-lived and profitable railroad.

Collis Huntington died in 1900.

From the August 15, 1900 New York Times:

MR. HUNTINGTON'S CAREER.

As a Railroad Builder, Financier, and Resourceful Man of Business, He Stood Pre-eminent.

Collis Potter Huntington, railroad magnate--one of the six men who are at the head of the American railroad systems--multi-millionaire, one of the greatest land holders of the United States, are connoiseur and patron, humanitarian, and patient, hopeful, resourceful man of business and financier, had a remarkable career in his long and successful span of eight decades. On his death came full recognition of one of his chief characteristics. "He was a builder up, not a puller down," said a millionaire business associate. He was a walking cathedral beside Commodore Vanderbilt, who did not build his roads, while Huntington constructed them mile by mile into systems. Take the very reverse of Jay Gould and you have Huntington. Wall Street, the business community, and the Americanism that is embodied in fealty to trust and go-aheadedness never saw his equal....

Friday, September 23, 2011

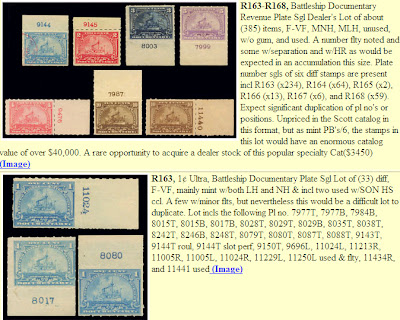

Auction Results: Sam Houston Philatelics Sale of Battleship Plate Number Singles

Sam Houston Philatelics has listed the results of its September 17 auction. Posted on Stamp Auction Network, the auction included several lots of battleship plate number singles.

I can't quite understand how they valued the lots. At first I thought they were valued according to the value of the unused singles in the Scott Catalogue. Yet many of the lots as described and priced don't even get close to the listed value.

To no surprise, the singles sold across the board for less than their posted price. Battleship plate number singles are relatively common, while plate blocks are scarce and some quite rare. The sale results:

Lot 448 Collection of R163-R168 plate number singles (photo at top), 385 stamps, As claimed, Scott value for singles: $3450, Lot listed for $1800, SOLD for $675.00.

Lot 449 33 1ct Documentary plate number singles. Listed for $245.00, SOLD for $115.00.

Lot 450 35 2ct Documentary plate number singles. Listed for $265.00, SOLD for $100.00.

Lot 451 6 4ct Documentary plate number singles. Listed for $250[!], SOLD for $80.00. What catalog values six 4 cent battleships for $250? I have yet to see the 2012 catalog. Is there something I don't know?

Lot 452 Six 5ct Documentary plate number singles. Listed for $165 [!], SOLD for $30.00.

Lot 452 Eleven 10 cent Documentary plate number singles. Listed for $320. SOLD for $60.00.

Seems to me we have two phenomena happening here:

- All the lots are hugely overvalued by the auction firm.

- The lots drew good prices, relative to their real value, not relative to Houston's valuation.

Thursday, September 22, 2011

New York Stock Brokers: Clark, Dodge & Company

C.D.&CO.

JUN

18

1902

NEW YORK

Langlois scan

Louis Crawford Clark, member New York Stock Exchange

1897 photo available from King's Views of the New York Stock Exchange

Wednesday, September 21, 2011

Auctions: Perfume Bottle with 1 7/8 Cent Proprietary Battleship

A reader of this site conducting research on the stamp attached to the bottom of the bottle sold in the above eBay auction drew my attention to this item. The bottle was listed under Antiques...Perfume Bottles and Collectibles...Decorative Glass. The item was not listed under revenue stamps.

A 1 7/8 cent stamp, especially a hyphen-hole copy like this one, is quite scarce if not very rare on a bottle like this. The stamp is not in the greatest shape, but this type of stamp on its original bottle shouldn't be dinged too much for being a bit ragged.

The 1 7/8 cent stamp indicates that the original retail price for this bottle (with the perfume inside!) was between 50 and 75 cents. Does anybody know the maker and the brand of this perfume?

The reader of this site that drew my attention to this bottle and stamp specializes in old glass bottles like this. She wrote that this type of bottle would likely not have been used as a commercial bottle for perfume. The stamp tells us otherwise, but could something else be happening that we don't know about? She thinks the bottle might have been made by Reidel, but could also be the product of Moser, Baccarat, or Harrach.

*****

Update September 24, 2011: A perfume expert was consulted and the educated guess is that a perfume made by Lazell was sold in this bottle. The same expert confirms that the stopper does not match the bottle, and was made in the 1920s for a Colgate product.

Tuesday, September 20, 2011

New York Stock Brokers: Ellingwood and Cunningham

New York Tribune classified advertisement

January 3, 1903

ELLINGWOOD & CUNNINGHAM.

NEW YORK.

Langlois scan

Ellingwood and Cunningham went bankrupt in 1907. The bankrupt firm was a central part of a case against graft and corruption among New York legislators in Albany. I expect that the search of histories of cancels on this site will lead to repeated scandals associated with New York and Tammany Hall. I don't know what became of either Ellingwood or Cunningham.

From the Toledo Blade from September 15, 1910:

The Auburn Weekly Bulletin of April 15, 1910, featured the following:

15 MORE NAMES ON IT

Watson Says Hotchkiss Didn't Give Out Complete List.

SENATOR AND ASSEMBLYMEN

New York Lawyer Calls Ellingwood & Cunningham a "Clearing House for Lobbying"

Monday, September 19, 2011

Northern Pacific Railway Waybill from New Salem, North Dakota

Chas. F. Peterson

SEP 22 1899

New Salem, N. Dak.

Northern Pacific's lines through North Dakota ran south of the Great Northern Railway's main line. Towns like New Salem were founded by settlers establishing themselves along the railway lines. As with yesterday's post where Minot, North Dakota got its start through the presence of the Great Northern, New Salem exists because of the Northern Pacific.

The heavy red line represents the NoPac's mainline. Minot, a town on the Great Northern mainline, is due north of New Salem, North Dakota. This map is from 1900.

Sunday, September 18, 2011

Cancel for September 19: Great Northern Bank?

G. N. B'k

SEP

19

1898

In 1897, a bank was opened in Minot, North Dakota called the Great Northern Bank. While I can't confirm this cancel was made by this bank, it is my best guess. Anybody with an old check from this bank from July thru late 1898 on could help confirm my guess.

James J. Hill's Great Northern Railway passed through Minot; the railroad founded and was largely responsible for the growth and building of the town.

The Great Northern Bank of Minot would become the 2nd National Bank of Minot

Saturday, September 17, 2011

The Northern Pacific Railway and the 1901 Stock Market Panic

Northern Pacific Railway Company check with tax imprint. Check written for 60 cents!

During the years of use of the 1898 series tax stamps occurred one of the first crashes on Wall Street. The crash centered on the trading of the stock of Northern Pacific. The A. A. Housman post from yesterday hints at the role of Arthur Housman in helping to stabilize the market after it had begun to crash.

The Northern Pacific was a railroad built to run from the midwestern United States and the twin cities of Minneapolis and St. Paul to the Pacific coast, cutting across the northern tier of US states. Despite the great distance from the financial center in New York City, the stock of the Northern Pacific would have a major impact on the New York Stock Echange's operations in 1901.

****

Gilded Age barons fought for control of the Northern Pacific Railway. The main characters included James J. Hill, builder of the Great Northern Railway, J.P. Morgan, the greatest financier of the time and arguably of any age, Edward H. Harriman, the Chairman of the Union Pacific, William Rockefeller, the brother of John Rockefeller of Standard Oil, and Jacob Schiff, a leading New York financier.

Harriman used his holdings of Union Pacific to speculate in and attempt to monopolize rail traffic in and out of Chicago. James J. Hill, the St. Paul, Minnesota-based head of the Great Northern Railway fought Harriman to prevent his control. Hill had J.P. Morgan as an ally, while Harriman had resources from Standard Oil via William Rockefeller.

Attempts to buy up Northern Pacific stock on the NYSE started a panic on May 17. Investors and brokers began to dump stocks and prices began to fall dramatically, especially in railroad issues like the Chicago, Burlington & Quincy, the Missouri Pacific, and the Union Pacific. Arthur Housman showed up on the floor and began buying for J.P. Morgan, helping to stabilize the market.

In the end Harriman and Hill decided to join forces and created a holding company to control the NoPac, Great Northern, and the Burlington. The holding company was broken up through the application of the Sherman Antitrust Act of 1890.

****

Frank Sente discussed the 1901 crash and the precursor trading in the Chicago, Burlington & Quincy Railroad in this post from April 23, 2011.

****

Meanwhile, many of the corporate players in this stock market meltdown were users of 1898 series revenue stamps. Let's take a look:

Great Northern Railway:

Chicago Burlington & Quincy Railroad:

Union Pacific:

Standard Oil:

J. P. Morgan:

Arthur Housman:

Friday, September 16, 2011

New York Stock Brokers: A. A. Housman & Company

HOUSMAN

Cancel from the firm A. A. Housman & Company. A. A. Housman was Arthur A. Housman.

This firm puts us squarely in the middle of Wall Street history. Arthur Housman was a partner of William Burrill in the firm Burrill & Housman, formed in 1885 (the firm Burrill & Stitt will feature in a future post). Arthur Housman formed his own firm called A. A. Housman & Co. in the 1890s and under this name was a broker for J. P. Morgan. He is credited with playing a prominent role in restoring calm during the Panic of 1901.

The panic of 1901 was the first crash of NYSE and occured due to a fight over control of the Northern Pacific Railway. Arthur Housman would eventually take on Edward A. Pierce and Bernard Baruch as partners. After Housman's death in 1907, Edward Pierce would control the firm and it would be renamed E. A. Pierce & Company. This company would be the largest brokerage in the US through the 1930s. Eventually it would form partnerships that would result in a new company by 1940 called Merrill Lynch, Pierce, Fenner & Beane.

Bernard Baruch is one of the most famous Wall Street "lone wolves." Though he began his career at A. A. Housman, he left and took his substantial earnings to buy his own seat on the New York Stock Exchange. By 30 he became extremely wealthy, and for the majority of his life he spent his time as an advisor to Presidents Roosevelt and Truman and as a philanthropist.

Subscribe to:

Posts (Atom)