Stamp washing and reuse was somewhat common on the 1898 dollar values, prompting ink experimentation that would help prevent effective cancel washing, and rules regarding stamp cancellation that required not only ink cancellation but mutilation through cuts or punch-outs.

By late 1899, cancel washing and stamp reuse had become so common that the Commissioner of Internal Revenue made it mandatory for all revenue stamps of 10 cents or more be mutilated by three parallel cuts into the stamp. So from January 1900, many of the dollar denominated revenue stamps are found with cut cancels. The regulation seems to have been mostly ignored for the documentary battleships.

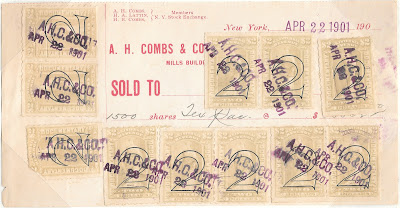

Today is featured 8 $1 stamps that have been appropriately cut cancelled. However, they have been stacked on a stock sale memorandum. While the regulations regarding cancelling don't address stacking the stamps this way, I do not believe this way of applying the stamps to the document would have been approved by revenue agents.

A Malcom & Coombe sale memorandum to Eames & Moore for 400 shares of Southern Railway requiring $8 of revenue stamps:

A review of section six of the earler 1898 war revenue law makes no mention of a prohibition of stacking stamps before cancelling them. However, the law does say:

That in any and all cases where an adhesive stamp shall be used for denoting any tax imposed by this Act, except as hereinafter provided, the person using or affixing the same shall write or stamp thereupon the initials of his name and the date upon wich the same shall be attached or used...

It seems to me that it is implicit that in order for the above to be enforced, all the stamps on the document must be visible. At least in this sense the stacking on the Malcom & Coombe memo is not permitted.

Certainly, stacking wasn't necessary to fit all the stamps on the memo of sale. Here are two examples of extensive real estate use on stock sale memos:

No comments:

Post a Comment