Frank Sente and I have been exchanging emails concerning the volumes of Compilation of Decisions rendered by the Commissioner of Internal Revenue under the War Revenue Act of June 13, 1898, which contained a list of printers licensed to furnish imprinted paper. I have been wanting to see the January, 1902 edition to see which printers were still listed, presumably to continue imprinting parlor car tickets until the end of the tax period on June 30, 1902. Frank found a copy online for me, and I eagerly downloaded it. Unfortunately, it didn't contain the usual list of printers, probably assuming that any on the list in the 1901 edition could continue to function for an extra year if requested by a user. However, one section of it did shed some light on another thing that has been puzzling me.

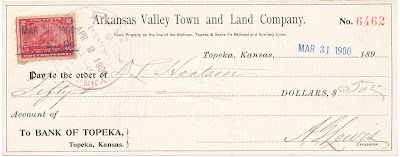

On July 1, 1901 checks and drafts payable on order or at sight were no longer taxable. Imprinted paper could be sent in for a refund of the tax paid. Checks with a round hole punched through the imprint indicate that it was sent in for redemption and returned to the owner for subsequent use. I have been looking for an example used in 1901, or even 1902, without success. The check below, used in April of 1903, is the earliest I have come across so far.

One item in the 1902 Compilation explains why I never will find a 1901 example, and why 1902 use may exist, they will be few and far between. From pages 193 - 194:

(403)

Redemption of imprinted stamps.

Under existing laws it is not possible to return checks to the owners after the imprinted stamps have been redeemed, but they will be preserved subject to future action of Congress.

TREASURY DEPARTMENT,

OFFICE OF COMMISSIONER OF INTERNAL REVENUE,

Washington, D.C., August 15, 1901

To collectors of internal revenue and others concerned:

Application having been made to this office by banks and bankers for the return, after redemption of the stamps, of checks on which stamps have been imprinted, you are advised that when the war-revenue act imposing a tax on checks and notes went into effect, at the request of the bankers, and to meet their convenience, a system of imprinting the 2-cent stamps on checks was devised by this Bureau, which was a great saving of annoyance and trouble to the banks and their customers.

Upon the repeal of the stamp tax on checks by the Act of March 2, 1901, the question arose as to the redemption of such imprinted stamps, and instructions were issued March 22, 1901 (Circular N. 596), relative to redemption of documentary and proprietary stamps.

This office has been requested to cancel the imprinted checks, after allowance of the claim for redemption, in such a manner as to render their future use possible, and return them to the original owner in order to effect a saving to the owner or bank of the cost of stationery and the binding of the checks and drafts in book form.

The extent to which these imprinted stamps are being presented shows that a large pecuniary loss will fall upon banks and owners if the checks and drafts are destroyed, after refund is made for the stamps thereon.

After careful consideration of this whole question, the conclusion reached is that, under existing laws, it is not possible to return these instruments to the owners, but this office will proceed as rapidly as possible to consider the claims for redemption, and refund to the owners the amounts due by reason of the stamps imprinted; will cancel those instruments so as to allow their future use; will preserve the various checks, and will recommend to Congress, at its session in December next, to pass a law under which it will be possible and legal to return these checks and drafts to the claimants and owners.

It is understood that the banks will also petition Congress for relief, and in this way it is believed speedy action may be had.

J.W. YERKES, Commissioner

*****

The 1903 Compilation volume contains the following:

(509)

Cancellation of imprinted stamps and return of imprinted instruments to their owners.

[Circular No. 42 - Int. Rev. No. 623]

TREASURY DEPARTMENT,

OFFICE OF COMMISSIONER OF INTERNAL REVENUE,

Washington, D.C., April 25, 1902.

The joint resolution authorizing the Commissioner of Internal Revenue to return bank checks, drafts, and certificates of deposit, and orders for the payment of money, having imprinted stamps thereon, to the owners thereof, approved February 26, 1902 provides:

That the Commissioner of Internal Revenue be, and is hereby, authorized to return said imprinted instruments to the owner or owners thereof, where said return is demanded within one year after the passage of this Act, after the redemption and cancellation of stamps printed thereon, and said cancellation and return to the owner or owners shall be made in such manner and under such regulations as may be prescribed by the Commissioner of Internal Revenue and approved by the Secretary of the Treasury. All such checks and drafts, and so forth, remaining unclaimed by the owner at the expiration of one year after the passage of this Act shall be destroyed in such manner as may be prescribed by the Commissioner of Internal Revenue and approved by the Secretary of the Treasury.

In pursuance of the authority conferred by the resolution aforesaid, it is herein provided that all revenue stamps imprinted upon checks, drafts, and other instruments shall, after their redemption and before the return of the said instruments to the owners thereof, be canceled by perforating or cutting a round hole about one-fourth of an inch in diameter therein, or through the instruments on which the said stamps are imprinted. After the redemption and cancellation of the stamps as aforesaid, the imprinted instruments may, upon the request and at the expense and risk of the owners thereof, be returned to said owners either by freight or express, as may be desired.

Requests for the return of imprinted instruments must be made in writing, addressed to the Commissioner of Internal Revenue, signed by the owner or his duly authorized agent, and shall specify distinctly by description and number the instruments to be returned, the manner of return, whether by freight or express, and give plainly the address to which the instruments shall be forwarded.

All imprinted instruments remaining unclaimed by the owners on February 26, 1903, shall be destroyed by burning under the supervision of the committee appointed by the Secretary of the Treasury to superintend the destruction of stamps, notes, bonds, and other Government securities.

Imprinted instruments may be destroyed as aforesaid at once upon receipt of notice from the owner that the return of such instruments is not desired.

ROBT. WILLIAMS, Jr., Acting Commissioner,

Approved: L.M. Shaw, Secretary of the Treasury

*****

Since Congress did not pass the IRS recommendation until February 26, 1902 there cannot be any redeemed check uses in 1901. The IRS did not act until April 25, 1902, and, as a practical matter, the process adopted then had to be announced to the banks and made available to the public.

In the meantime, as banks were using their drafts they might be falling below the required hundred necessary for redemption - the same being the case with individual users. This may account for many of the imprinted ones used after 1901 without the stamp having been redeemed. At first people didn't want to lose their checks, and later they didn't have enough to send in.

At any rate, it appears possible for checks to have been returned to users in time to be used in the last half of 1902, but not much before that. I'll continue to look for one dated in that year, but I now know why they are not so common as I thought they should be.